In a recent edition of “The GRC Compass” newsletter on LinkedIn, Vaishali Moitra (Senior Analyst, QKS Group) compellingly argued that Governance, Risk, and Compliance (GRC) has shifted from a reactive necessity to a core operational imperative.

Building on those insights, this article explores why, in today’s landscape of digital transformation, evolving regulations, and complex cyber risks, an integrated GRC approach is no longer optional but a fundamental strategic necessity for modern enterprises seeking resilience and growth.

In an era marked by accelerating digital transformation, ever-evolving regulatory mandates, cyber risks, and heightened stakeholder scrutiny, Governance, Risk, and Compliance (GRC) is no longer a check-the-box exercise—it’s an operational imperative.

While many organizations still perceive GRC as a reactive set of compliance-driven tasks, the reality has shifted. Today, GRC platforms are mission-critical systems that unify risk management, regulatory compliance, and corporate governance into a strategic layer of decision-making and performance management.

So why should end users—whether compliance managers, risk officers, CIOs, or board members—care deeply about GRC? Let’s break it down.

1. Real-time Risk Visibility

A centralized GRC system provides real-time dashboards, risk heatmaps, and automated alerts. This empowers end users with a 360-degree view of organizational risk, enabling faster, data-backed decision-making.

Without this visibility, organizations fly blind in an increasingly high-risk world.

2. Strengthened Compliance Posture

Modern GRC platforms automate regulatory tracking, policy management, and audit workflows. This not only reduces the risk of non-compliance and fines but reduces manual effort significantly.

End users save time, improve accuracy, and avoid last-minute fire drills when audit time comes.

3. Cross-Functional Collaboration

GRC enables shared responsibility across departments. Whether it’s legal, IT, finance, or HR—GRC platforms foster a culture of accountability through workflows, attestation tracking, and aligned objectives.

This breaks silos and encourages collective ownership of risk and compliance.

4. Business Resilience & Continuity

A proactive GRC strategy allows businesses to anticipate threats, assess impact, and deploy mitigation strategies long before a crisis hits. This translates to greater resilience—both operationally and reputationally.

5. Alignment with Business Objectives

With GRC tightly integrated into enterprise performance frameworks, organizations can ensure that risk appetite aligns with strategy. This helps avoid over-compliance or reckless innovation.

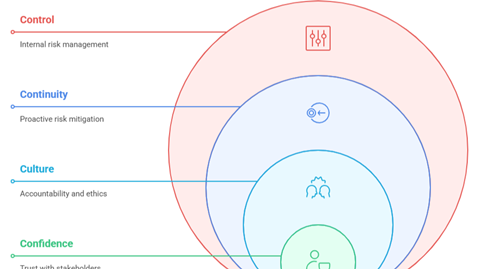

A Simple Framework: The 5Cs of Modern GRC

Why It Matters Compliance Adhere to evolving global regulations and avoid legal penalties Control Implement internal controls to manage risk at every level Continuity Ensure business continuity through proactive risk mitigation Culture Foster accountability and ethics across departments Confidence Build trust with regulators, investors, customers, and partners

Final Thought

GRC is no longer about documents, spreadsheets, or annual audits. It’s about resilience, agility, and strategic foresight. For end users, embracing GRC means gaining control over the unknown—and empowering organizations to thrive, not just survive.

If you’re still viewing GRC as a backend compliance tool, it’s time to reframe the narrative.

Let’s talk: How are you using GRC to unlock competitive advantage?

Vaishali Moitra, Senior Analyst IRM, QKS Group | Market Research | Competitive Analysis & Qualitative Analysis

This article was origionally published on The GRC Compass

No comments yet