Experts at FinCrime World Forum have asked how the public and private sectors can better measure the effectiveness of action taken in the fight against financial crime.

What “effectiveness” means within FinCrime is the subject of much discussion. The Financial Action Task Force (FATF) has, so far, set the global standard by taking a subjective approach – assessing “how well” businesses reach regulatory compliance. However, the US federal government’s Financial Crimes Enforcement Network (FinCEN) advocates a metrics-led strategy through a programme that delivers ‘useful’ Suspicious Activity Reports (SARs) – financial intelligence that materially helps law enforcement investigations.

Despite these different takes, measuring effectiveness remains ambiguous as a term for many stakeholders across public and private sectors, and is often simply understood as measuring outputs and efficiency, rather that outcomes and impact.

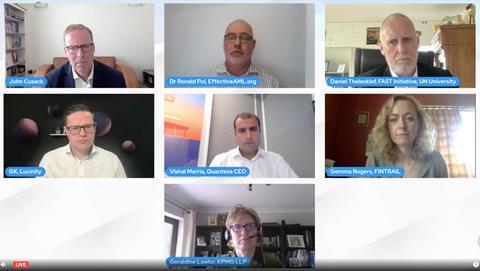

John Cusack, Global Lead Partner for Financial Crime at KPMG LLP hosted the exclusive panel debate, Moving the needle: Defining, measuring, and improving FinCrime effectiveness at FinCrime World Forum.

Geraldine Lawlor, Global Lead Partner for Financial Crime, KPMG LLP, said:

”We cannot deal with financial crime in isolation. It’s a global problem that is tended to be dealt with locally. It’s not new to anyone, we all know what the problem is but it’s about being brave and to start thinking about what the fix is.”

Dr Ronald Pol, Director and Principal, TeamFactors.com and AMLassurance.com, said:

“The effectiveness problem is the system is pointed at one thing, while claiming to achieve something completely different.”

Gemma Rogers, Co-founder, FINTRAIL, said:

“I spend a lot of time working with emerging technology platforms. For me effectiveness really comes into play in the FinTech world, so notions of efficiency and effectiveness are at the heart of most products, and therefore at the heart of anti-FinCrime programmes, too.

“Being compliant has become the goal, rather than taking an innovative approach to managing controls. A shift to effectiveness, defined as doing the right thing for the right reason, rather than focusing on a tick-box exercise, is what we need to be seeing.

A focus on effectiveness will make sure we’re stopping the harms associated with Financial Crime, but it will enable better innovation to help us get ahead of the criminals rather than chasing our tales. We need to move from a vicious to a virtuous cycle in the fight against FinCrime.”

Daniel Thelesklaf, Director, Finance Against Slavery and Trafficking, UN University – Centre for Policy Research, said:

“Speaking in a personal capacity, I’ve been attending FATF meetings for the past 25 years or so. Comparably, global AML standard has more effect on what countries are doing. It’s so much better than what we have in other fields.

“FATF have made a major step forward over the last ten years. No other global standard is trying to assess effectiveness of implementation. The fact the FATF has dared to do this, and has agreed on a standard, I’ve never seen that before.

“I strongly agree we could do better, and that we need more outside views on this discussion. I think we need more transparency to the process to avoid misunderstanding, and we should be more inclusive, having more countries at the table playing by the rules.”

Vishal Marria, CEO, Quantexa, said:

“Many compliance officers now are looking at whether we’re capturing the bad criminals. Partnership is huge – not just within an organisation, but across private and public sectors, partnerships constitutes a fundamental component to success. It’s now the execution that we need to focus on.”

GK, CEO, Lucinity, said:

“We need to remember that money laundering is a huge crime, and that whenever it is present through an organisation, there is a threat to a financial institution being exposed, and this is costly.

“We have not been very effective in making the business-case for anti-money laundering. In financial institutions, it’s about convincing chiefs that AML is good business.”

No comments yet